Dates

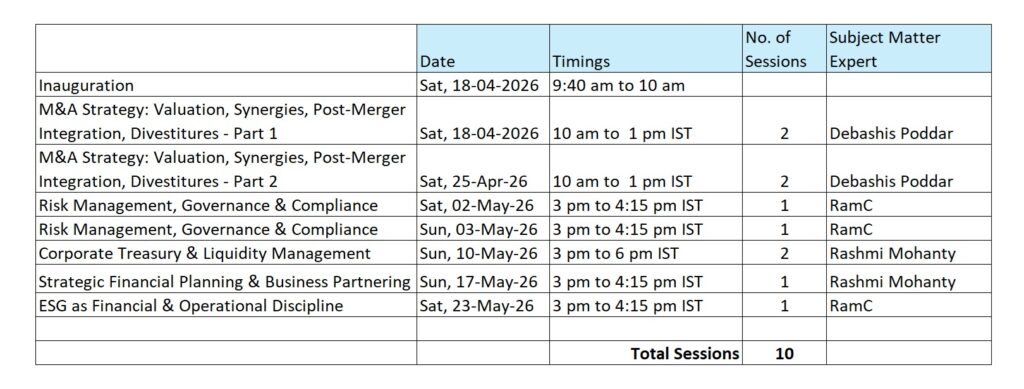

Start Date: Saturday, 18 April 2026

Register By: 10 April 2026

Early Bird Deadline: 03 April 2026

Program Fee

Regular: Rs. 37,000 + GST

Early Bird Fee: Rs. 33,300 + GST

Duration

Live-Online over Zoom

10 sessions over 6 weeks

Click below to “Enroll and Pay” for the program – Enroll and Pay

This masterclass is designed for CFOs and senior finance professionals operating at the intersection of strategy, capital allocation, risk, and governance. As the finance function evolves from financial stewardship to enterprise leadership, participants will engage with advanced frameworks, real-world decision scenarios, and board-level perspectives that reflect the realities of today’s complex business environment.

The Masterclass integrates M&A and portfolio decisions, strategic financial planning, treasury and liquidity management, enterprise risk, and ESG-linked value creation equipping finance leaders to act as trusted advisors to CEOs, boards, investors, and regulators. The emphasis is on judgment, trade-offs, and executive influence, not tools alone.

The Masterclass would focus on sharing share practical insights and experiences through examples and caselets. This is not a program that focuses on theory since the participants are expected to be already familiar with the basic concepts.

By the end of the masterclass, participants will be able to:

Drive Enterprise Value Through Strategic Capital Decisions

Lead M&A, divestitures, and portfolio rationalization decisions with a clear link to long-term value creation.

Balance growth, returns, risk, and strategic coherence across the enterprise portfolio.

Integrate Strategy, Finance & Performance Management

Align corporate strategy with financial planning, rolling forecasts, and performance metrics.

Position finance as a proactive business partner and strategic co-pilot to leadership teams.

Strengthen Liquidity, Funding & Financial Resilience

Optimize cash flow, working capital, and funding structures across market cycles.

Manage financial risks related to FX, interest rates, commodities, and market volatility.

Enhance Enterprise Risk, Governance & Control Frameworks

Strengthen ERM, internal controls, audit effectiveness, and compliance readiness.

Elevate risk conversations to the board level with clarity and strategic relevance.

Embed ESG into Financial Strategy & Valuation

Integrate ESG considerations into capital allocation, valuation, and cost of capital decisions.

Build finance-led credibility in ESG measurement, reporting, and assurance.

Elevate Board-Level Communication & Executive Influence

Translate complex financial, risk, and ESG insights into compelling narratives for boards and investors.

Lead high-stakes decision discussions with confidence, credibility, and strategic clarity.

This masterclass is designed for senior finance leaders who operate at the intersection of strategy, capital, risk, and governance, and who regularly engage with CEOs, boards, investors, and regulators.

Primary Audience

Chief Financial Officers (CFOs)

Deputy / Group / Divisional CFOs

Finance Directors and Controllers with enterprise-level responsibility

Secondary / Adjacent Audience

Senior Finance Business Partners

Heads of FP&A, Strategy Finance, or Performance Management

Leaders responsible for M&A, Capital Allocation, or Portfolio Strategy

Risk, Compliance, or Governance Leaders reporting into the CFO function

Experience Profile

Experience: Typically 12–25+ years of professional experience

Seniority: Executive leadership or one level below the C-suite

Decision Scope: Ownership or strong influence over:

Capital allocation and funding decisions

M&A, divestitures, and portfolio strategy

Financial planning, risk management, and governance

Board reporting, investor communication, and regulatory engagement

For Participants

Strategic Clarity:

A stronger grasp of how finance drives enterprise strategy and long-term value.

Decision Frameworks:

Practical tools for M&A, capital allocation, liquidity management, and ESG integration.

Board-Readiness:

Confidence to lead complex financial, risk, and ESG discussions at the board level.

Enterprise Perspective:

A holistic view of risk, governance, performance, and sustainability as interconnected levers.

Executive Presence:

Enhanced ability to influence outcomes through clear financial storytelling and judgment.

For the Organization

Stronger CFO & Finance Leadership Bench

Improved Capital Allocation & Portfolio Decisions

Greater Financial Resilience & Risk Preparedness

Credible ESG Integration into Strategy & Reporting

Higher Board and Investor Confidence

Debashis Poddar is a Strategic Advisor and Global Inorganic Growth Enabler. Former SVP and Global Head, M&A and Strategic Investments for Tata Consultancy Services Ltd.

Strategic Thinker. Cross border M&A Leader. Global Experience. Complex and Creative Transactions. Risk Mitigator. Strong Network. Exceptional Team Leader.

An expert in Cross Border M&A spanning all continents with successful deals in Asia, America, Europe, Africa and Australia. Created and led M&A and Strategic Investment globally for a $125B marketcap and $30B revenue enterprise for past 24 years when the company grew 35x. M&A contributed to ~20% of revenues. Have done deals greater than 50 deals worth $2.5B. Covered 50 countries scouting for deals across all continents.

Rich M&A, Strategic Investment and Private Equity experience predominantly on the buy side. End to end capability of strategy formulation, deal generation, analysis, assessing risk, valuation, structuring, negotiation, closure and monitoring. Strong experience in the area of Corporate Strategy. Rich experience in creating Joint Ventures, captive transactions and managing investment exits.

Track record of active intervention and restructuring for problem investments or businesses. Global network. Strong credit and risk background.

He has actively participated as Director on Boards including being Chairman of a company. Has been an active member of investment committee of 2 venture funds. Has spent time in USA (as part of Global Leadership program of GE) and UK (as part of Chevening scholarship for Young Bankers). Travelled extensively.

Always seeking to create long term recurring value through through strong sourcing, negotiation, structuring and execution experience. Debashis Poddar completed his PDGM from IIM Bangalore in 1994.

AS Ramachandran is an international banker with over 30 years of experience, having held various country/regional/global leadership positions at Citibank across 5 countries – UK, the Netherlands, Singapore, India & Vietnam. He has a strong track record in setting new strategies and executing on them, transforming businesses and teams to high performance, and establishing the highest standards of governance.

Some of his key roles were: Global Coverage Head for EM MNCs, Eastern Europe Head for MNCs, CEO of Citibank Vietnam, Branded Consumer Industry Head for Citi India.

RamC was the Chairman of the American Chamber of Commerce Vietnam in 2024 and served on its Board in 2022 & 2023.

Through his extensive travel to 37 countries across Asia, Europe, Africa & Latin America, RamC has insights on the latest trends, opportunities and global best practices. He has an extensive international network.

RamC lives in London, holds a bachelor’s degree in Computer Science from the BITS Pilani (India) and a PDGM from the IIM Bangalore (Class of 1992-94).

Rashmi Mohanty is a C-suite finance leader with over three decades of experience across banking, NBFC, and mining & metals. She currently holds the position of Chief Financial Officer at SBI Cards. Her expertise spans derivatives and debt capital markets, capital structure optimization, complex financing solutions, controllership, planning and budgeting, with a proven record of raising multi-billion-dollar capital, executing transformational M&A, and strengthening balance sheets.

She has worked closely with Boards, CEOs, and global investors to drive growth strategies, enhance governance, and deliver shareholder value. Along the way, she has led finance organizations through digital transformation, built high-performing teams, and implemented risk and control frameworks.

She has built and nurtured strong relationships across financial market participants and stakeholders, enabling impactful negotiations and long-term value creation. Recognized for her credibility, she brings both technical mastery and strategic foresight to every role she takes on. She also engages with industry and academia through guest lectures, speaker at industry forums.

Rashmi is also an ultramarathoner, a discipline that mirrors her professional ethos of endurance, resilience, and pushing beyond limits. She is a BE in Computer Science from DIT, Delhi and a PGDM from IIM Bangalore (Class of 1993-95).

Delivery Mode: Live-Online through Zoom

We offer an additional 5% discount on group registrations for 3 or more people from a single organisation. Please email support@labinmotion.com for group registrations, and we will guide you through the enrollment process.

NOTE: The sessions would NOT be recorded and participants are expected to attend the sessions live-online.

Parthasarathy S

Ph. +91 9110614400

Email: partha@labinmotion.com