“Some people get rich studying artificial intelligence. Me, I make money studying natural stupidity.” (Carl Icahn, Legendary Activist Investor)

In my many years of being a part of the AI Investment world, the question that I get asked most often is “Does AI really make more money than conventional funds?”

The answer to this question, (like all “million-dollar” questions) is “it depends” – on who you ask, on your expectation and how you evaluate and for how long.

However, one thing is certain – AI investment is here to stay and if I may dare to suggest, it IS mainstream (will probably soon be a megatrend).

The facts to support my belief are quite simply to apply the same model that is applied in most business cases: Is it faster (to find patterns), is it cheaper (than hiring people) and is it better (at giving yield)? The answer to the 1st question is a big “yes”, to the 2nd one “probably” and the 3rd one “yes, but…”

In the following few paragraphs I will try and explain the above in detail, delving into the history of AI investing, the current status and projected future scenarios. Here I have focused purely on “AI in Investing” and I have intentionally avoided referring to established historical facts about the Machine Learning, Turing’s Test, Algorithmic Computing, Anecdotes like IBM’s Deep Blue vs Kasparov in 1997 etc.)

Firstly, AI investing is not new. Many of the current issues discussed in the field of Artificial intelligence are the same ones that were brought up 50 years ago and in certain cases close to 90 years. The financial sector is one of the first domains to drive interest in using artificial intelligence, even before high computing machines were available. In the 1960’s, research focused on Bayesian statistics, a method used in machine learning even today. Some of its use cases included stock market prediction and auditing. However, it was in the 1980’s that commercialization opportunities were explored with expert systems. One of the first programs to be hypothesized for market prediction was the Protrader expert system designed by KC Chen (California State University) and Ting Peng Lian (University of Illinois) who predicted the 87 point drop in Dow Jones Industrial Average in 1986 using their system.

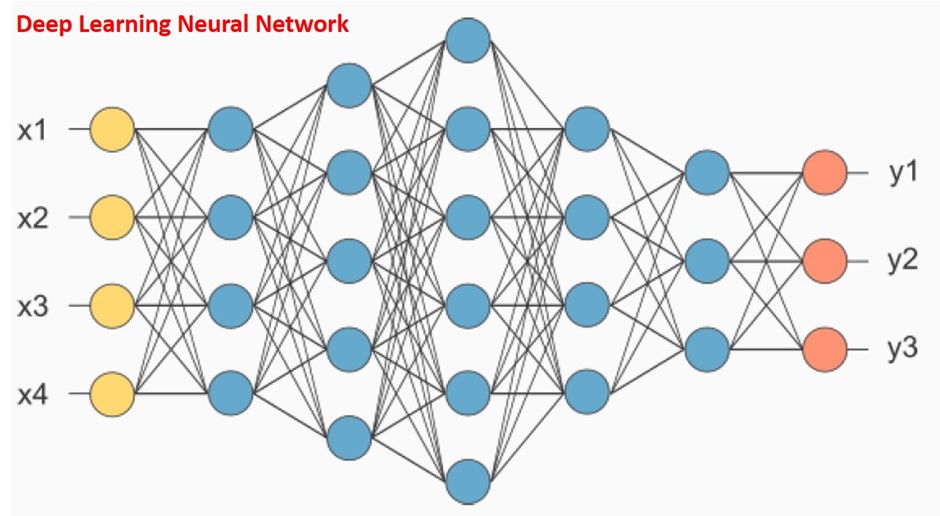

Jumping to the 21st century, massive technological changes have enabled the development of what is now known as “Deep Learning”

- Hardware – Exponential processing speed growth

- Data – Availability of billions of mass data

- Software – New models are open source

- Know-how – Critical mass of researchers

- Money – Considerable economic interest in the results

These in turn have led to a better “pattern recognition” – which is generally accepted is something that really separates intelligent beings (humans) from unintelligent creatures, and humans are very good at recognising similarities in different objects. This specific feature is where AI comes in and performs better than humans.

As Prof. Anil K Jain (Michigan State University) states: “Humans are excellent cluster seekers in two or possibly three dimensions, we need automatic algorithms for high-dimensional data”.

The above developments can (arguably) lead to the hypotheses that Deep Learning models have to be better than a human being in financial analysis, as Deep Learning models can process more data (much faster and without getting tired), remove human error and bias from the process, can detect the ‘human’ patterns, and find more complex, non-linear and multi-dimensional relationships as compared to factor investing.

Having established the fact that machines are indeed faster (and probably smarter), we need to jump to the next level, i.e., creation of investment models. Here again, there is a fundamental difference between Model Creations done between Humans versus Machines.

| MODEL CREATION DONE BY HUMANS | MODEL CREATION DONE BY AI SOFTWARE |

| • Based on a priori view of how markets work • Human comes up with an idea / thesis • Convictions / Drivers are codified • Run what “if” scenarios • Calibrate model based on feedback • Fix model and go live with it STATIC RULE BASED STRATEGIES | • No a priori view of how markets work • AI model generation system • Extract features from data • Build model from data • Map evolving relationships • Model continuously learn and adapt ADAPTIVE SELF-LEARNING STRATEGIES |

Here I would argue that the Model Creation by AI Software, tends to be better as it:

Learns from Historical Data – AI can learn the complex, non-linear relationships within the data better than any other method. AI will attempt to learn the structure and the important features from the data itself

Uses Probabilities – In probabilistic analysis, AI has a meaningful edge over human analysis AI can draw from a large set of inputs and determine overall probability assessments based an available data

Has a systematic approach – AI does not suffer from behavioural biases – confirmation bias, groupthink, and others and hence AI is not likely to contribute to these human failings; rather, AI can assess, catalogue, and exploit such phenomena

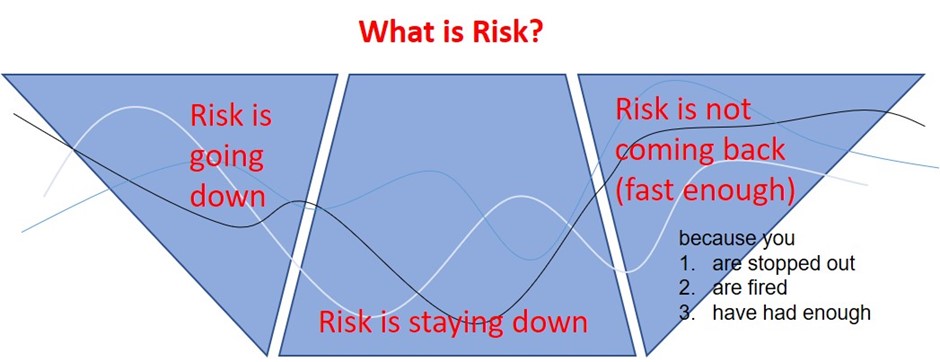

The above can be illustrated in simple terms by looking at the fact that although equities provide the best returns by far, people go for “balanced” solutions (say 60:40) to manage risk. In this scenario it is vital that during a market upturn the exposure to equities need to increase (say up to 90%) and go down to 10% during a downturn.

In real life terms the “real” client risk is not volatility but actual capital loss which can be classified under 3 categories: Too late to get out of a declining market, too much time spent in low market, too late in getting in during an upside movement

The challenge is to manage all 3 simultaneously (plus unemotionally) and regularly and then learn from the past and adapt and evolve. This I believe is not possible for humans over sustainable periods of time.

I also want to cover 2 upcoming fields which are still in the early stages of AI Investing.

Textual analysis – To illustrate with an example, it is impossible for a human to read last 20 years of annual reports (text) of a DAX company and find a trend or track a specific issue (e.g.: a particular drug development, or an investment in Latin America).

Another example is covering millions of news items, posts on social media and company websites across the world daily for a of a global corporation and deriving business sense leading to an investment outlook, where again a human being capacity is limited to accurately process and analyse this amount of information.

AI can help us do that far more efficiently (and cheaply) and accurately.

Market Sentiment – to again illustrate with an example, say because of a certain political development, or a scandal, etc, market sentiment turns negative on a particular industry, geography or even a stock leading to dumping. Although on one hand AI can potentially react faster to the market development, it is still not easy for AI to quantify a “sentiment”, as it is fundamentally not designed to do so. However as mentioned earlier AI “learns” and I expect over time AI to make progress in this area (in other words find out “what the market is thinking?”)

Conclusion

Fundamentally there exists a business case to adopt machines (even independent of results). Of course, there is the obvious danger of being wrong, but technological evolution has shown that the dangers of automation are overall significantly lesser than the benefits (e.g.: auto pilot in planes, weather predictions or billions of daily electronic transactions). Hence perhaps the strongest argument as of today would ideally be Man WITH Machines (instead of Man versus Machine), with a “manual override” as an option.

The only challenging aspect I see is more philosophical – if you lose money (or anything for that matter), human psychology always demands an explanation/reason – the portfolio manager will find it difficult to tell the investor „sorry – the machine lost money, bad luck.“ as it is not as easy task to figure out “why the machine did what it did”

———————-xxx———————-

Sources and acknowledgements:

Persons: Fred Sage, NextGen Alpha AG, Bryan Loughry ((formerly Northfield Trading & Prediction)

AI Funds: Acatis, Sanlam, Catana

Internet: The History of AI in Finance (Sydney Swaine-Simon)